The company is a British success story, but now its products risk becoming unaffordable luxuries

A decade ago, almost all of Stuart’s customers came into his vacuum cleaner store looking for Dysons.

“It was unusual to ask for anything else,” says Stuart, who has run specialist retailer Manchester Vacs since 2005.

Today, that has changed. Stuart says the rise of cheaper rivals and a sense that Dyson has lost its edge mean buyers are often looking elsewhere.

Sir James Dyson’s company revealed its first fall in sales in 22 years earlier this week. Credit: Isabel Infantes/PA Media Assignments

He claims that the growing popularity of thicker carpets in place of laminate flooring has boosted demand for more powerful plug-in vacuums over the cordless products Dyson is best known for. The latter achieved the near impossible – a vacuum cleaner that people were proud to put on their wall instead of hiding in a cupboard.

Dyson, founded in Wiltshire 34 years ago by the British engineer Sir James Dyson and now headquartered in Singapore, has long been seen as one of the leading names in household appliances.

An aspirational brand on a par with Apple, Dyson repeatedly revolutionised the vacuum cleaner, first with bagless designs and then through cordless models. Sir James achieved the unique feat of building a global consumer electronics empire from a base in Britain, and became a leading voice arguing for Brexit.

But challenges appear to be building. “They’ve gone as far as they can probably go,” Smith says. “The stuff that they’re bringing out now is interesting, but it’s gimmicky.”

Smith’s experience may not be universal, particularly as sales of the cordless vacuums that Dyson pioneered are still growing. Professional reviewers, including The Telegraph’s own, still laud their performance. But the company’s magic may be wearing off for some consumers as their spending power has been squeezed by inflation.

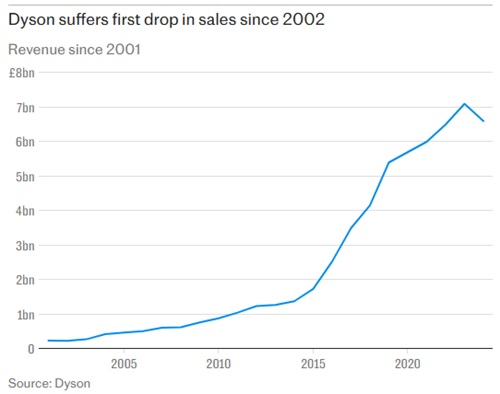

This week, Dyson revealed that global sales fell from £7.1bn to £6.6bn. Hanno Kirner, the chief executive, described 2024 as a “difficult year”, as profits were cut in half.

The decline is, in historical terms, a blip. Last year’s drop in revenues was the first in 22 years. Sales are also still more than four times what they were a decade ago, the result of a push into Asia and an expansion into hairdryers and styling tools.

While sales fell in financial terms, the company sold a record number of products, more than 20m. It also blamed one-off factors such as a fire in a factory in the Philippines, currency exchange rates, and a move away from direct sales to customers in favour of third-party sellers that take a commission.

But there have been other signs that its grip on customers’ hearts – and wallets – is weakening, at least in Britain. Sales in the UK, which once accounted for the majority of Dyson’s business but are now less than 10pc of revenues, fell from £417.1m in 2021 to £358.2m in 2023, according to the most recent filings for its British subsidiary.

The company said last year that it planned to cut around 1,000 jobs in the UK, roughly a third of its workforce. In both cases, it blamed increasing competition. Dyson did not comment when approached by the Telegraph. Kirner said this week that its global revenue decline was down to “one-off issues” and Sir James said the company had sold “more products than ever before”.

Meanwhile, rivals are picking up steam. SharkNinja, the US-based appliances maker, has made no secret of its attempts to ape Dyson’s success with its Shark vacuums and hair-styling products.

Shark has emerged as a fierce competitor to Dyson, especially on cordless vacuums

The two companies have repeatedly faced off in the courts over claims that SharkNinja has copied Dyson’s products, although the battle does not appear to have stopped the former from growing.

SharkNinja grew UK sales by 56% in 2023 to £683m, according to Companies House records, although this also included items such as kitchen appliances, where it does not compete with Dyson.

According to investor documents citing third-party data, the company had become Britain’s biggest seller of vacuums by 2022, with a third of the market. Dyson remains the leader in cordless vacuums.

Numatic, the British company behind the Henry vacuum, which is owned entirely by its 84-year-old founder Christopher Duncan, also increased sales by 9% last year to £241m.

The Dyson premium

Growing competition has come as the price of acquiring Dyson’s latest technology, with features like laser dust illumination, dust compression and hair detangling, has steadily crept up.

The company’s first cordless vacuum, the DC16 released in 2006, cost £99.99 at launch. 2016’s V8 cost £450, and the company’s current high-end cordless vacuum, the V16 Piston, retails for £750. Dyson does still sell earlier models at a lower price.

Dyson’s cheapest vacuum cleaner currently comes in at £249, compared to £149 for a Shark alternative. The company’s products still often feature in best buy lists. But Andrew Laughlin, a researcher at Which?, says increased competition is making it difficult for customers to justify a Dyson premium.

“For decades Dyson has led the way when it comes to sleek design and innovation for vacuums, air purifiers and even more recently hair tools, but these items come with a huge price tag – often £500 or more,” he says.

“Our testing shows that competitors are not only catching up when it comes to performance but are often a lot cheaper, too. The question now is whether Dyson can adapt, or risks being seen as a luxury that everyday households can no longer justify.”

Smith, of Manchester Vacs, says that where customers would have once shelled out on a top-of-the-range Dyson, they might now buy two cheaper models – a plug-in and a cheaper cordless Dyson.

Sales of many top-of-the-line gadgets are under pressure amid squeezed consumer spending, brought about by higher interest rates and rising supermarket bills. Apple’s iPhone sales, for example, have plateaued.

The growing secondhand market, accelerated by sites such as Facebook Marketplace and Vinted, is also proving increasingly popular among bargain hunters.

“Premium appliances are under siege from three fronts: savvy shoppers under financial pressure, the rise of resale platforms, and heightened competition,” says Nicholas Found of Retail Economics.

Image: Manchester Vacs

“A core demographic Dyson relies on – so-called ‘aspirational millennials’ – has been disproportionately exposed to sustained high interest rates. These are middle to high-income, younger to middle-aged consumers who are typically leveraged with debt, from large mortgages to cars on finance.”

Found says that when household budgets are squeezed, spending on high-end devices is disproportionately hit. “Premium appliances are among the first to be deferred, downgraded or dropped altogether to manage higher living expenses,” he says.

Retail Economics predicts that Britain’s secondhand market is set to double by 2028.

Hits and misses

Dyson is much more than a vacuum cleaner company these days. The company’s expertise in using tiny, efficient motors has been applied to fans, hand dryers, air purifiers, and perhaps most successfully, haircare.

Dyson said that products such as its Supersonic hairdryer and Airwrap styling tool accounted for 30% of its American business in 2023, making the division its fastest-growing. Fans of the Airwrap include Beyoncé and Lady Gaga.

But as it has branched out, the company has also had less successful launches. In 2022, it unveiled the Dyson Zone, a £750 set of noise-cancelling headphones with a built-in air purifier positioned over the owner’s mouth.

Jake Dyson wearing the new Zone air-purifying headphones in 2022. Credit: Matt Alexander/PA Wire

The company had worked on the Zone for six years but discontinued the headphones less than three years after their release, with Sir James’s son Jake Dyson conceding that customers had not taken to it.

It has followed up with the more conventional OnTrac headphones, which have won plaudits from reviewers.

Sir James also directed huge energy towards, and promised a £2.5bn investment in, an electric car project. Announced in 2017 and planned for 2020, the project was scrapped after two years as commercially unviable.

Sir James Dyson scrapped plans for an electric car in 2019. The company spends £8m a week on R&D

After cancelling the project, Dyson hoped its work on solid state batteries – a revolutionary chemistry promising 600-mile range – could be applied elsewhere, though no such product has yet appeared.

Sir James prides himself on the company’s engineering prowess and its appetite for risk. A prototype of the car still sits in Dyson’s Singapore HQ.

More recent innovations have focused on core products. In May, the company unveiled the “PencilVac”, the world’s slimmest vacuum, with dust collection housed in the handle.

Dyson filed 238 patents last year, up from 231 in 2023.

If the company’s next hit product is just around the corner, it couldn’t come at a better time.

This article was written by James Titcomb, Technology Editor at The Telegraph, with input from Manchester Vacs, who are regularly asked for media comment on vacuum-related stories.